Customer Lifetime Value, (CLV) is a key measure for understanding the value of customer groups.

Best not used as an overall value for your customer portfolio, but as a tool to understand where the value is different from one customer group to another. When we know the value from each customer group, the combination of that can be the overall value from your customer portfolio.

Recognising that, “Not all customers are equal” is a key tenet to being customer centric. Understanding this principle and the various value from different customer groups is critical to consciously growing business value fromyour customer portfolio.

Your customer portfolio determines the value of your organisation. There are two key elements to this value.

First, advocacy. How much positive word of mouth do you have..? To what degree do your customers refer their friends, family and colleagues to you. (read more on promoters and NPS)

Secondly, what is the lifetime value of your customer..? Which specific groups are worth the most and where is that two-way exchange of value really alive.

Customer Lifetime Value

Customer lifetime value (CLV) is a calculation that takes into consideration the value of your customers over time. Not just the initial purchase, but also potential repeat purchases, subscriptions and renewals. The financial value of the customer for the whole time they are with you.

My purpose here is to provide you with an approach to unlock insights into your customer portfolio and how to grow your customer base profitably. Further detail on CLV can be found (Peter Fader’s book and video). My purpose is not to prescribe a KPI. Using CLV can help you find those customer groups that are getting the value your deliver, and at the same time are delivering value back to you, this is the two-way exchange of value.

CLV Assumptions and Limitations

As with all calculations going into the future, there are assumptions and limitations, such as.

- The costs are known and constant.

- Margin is constant.

- Retention rate is constant.

- Calculated over an infinite horizon.

This is why I refer to customer lifetime value as eCLV – estimated Customer Lifetime Value. Too many people get hung up on the precision of CLV and allow themselves to devolve into uncertainty and no action. Some organisations have good data and the resources to pull this together and use CLV to great effect. But most seem to get bogged down into trying to get the calculation perfect. It is an estimate that can help you make more informed decisions about your customers.

The CLV Calculation

Here is how you can do the calculation, followed by some examples.

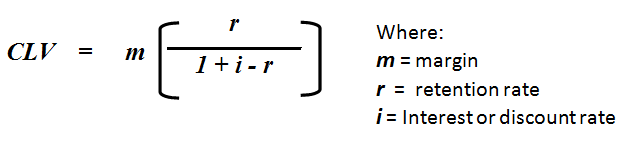

First the formula:

CLV Calculation [from Gupta and Lehman (2005) Managing Customer as Investments]

CLV is a discounted cash flow method. Recognising that a dollar today, is worth much more than a dollar next year, or even ten years from now. Therefore finance uses a method of discounting the value of those dollars in the future. For many types of investments organisations will use NPV or net present value. This technique discounts the future value of a dollar to today’s rate. CLV does exactly the same.

The data you need

Therefore the three pieces of data you need, or at least need to estimate for each calculation are: (1) the margin for a representative customer of the customer group (income less cost); (2) the retention rate of the customer group, and (3) your discount rate (check with your accountant or finance people. It is essentially the cost of your capital, such as the rate of interest on a business overdraft or loan.

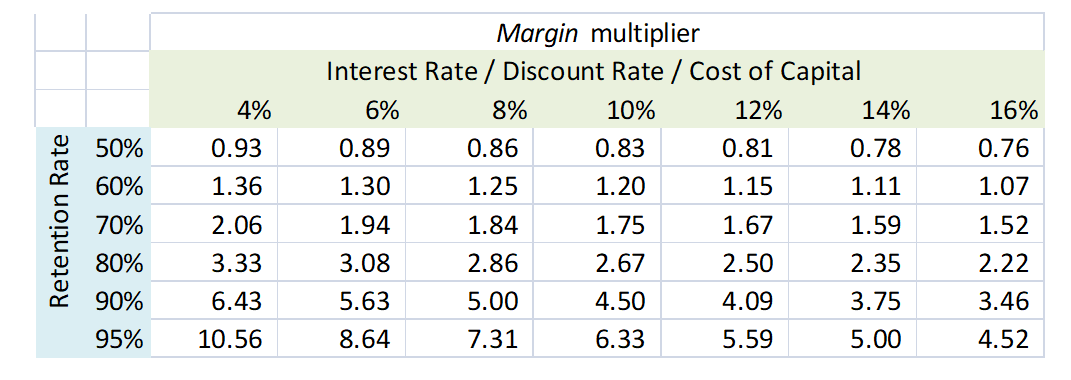

To simplify things we can translate the brackets of the above formula into a table, that gives us the multiplier for the margin.

CLV Calculation – margin multiplier by retention and discount rate [adapted from Gupta and Lehman]

Two CLV Examples

LinkedIn subscription

Let’s say a subscription to the premium version of LinkedIn is $47.99 per month. If we assume the cost of acquisition is $35, and the ongoing cost of the service is $4 per month. Total cost first year is: $83 (cost of acquisition plus service cost for the year), however ongoing years should only be a service cost of $48 (service costs of $4×12 months). Let’s say the cost of capital 8% per annum, and these premium subscribers have a retention 90% per annum.

Revenue from these customers is, $47.99 x 12 = $575.88 for the first year and subsequent years. The margin then is $83 less at $492.88, so let’s use this as the margin. Margin by the multiplier (from the table above for 8% interest rate and 90% retention) gives us: $492.88 x 5 = $2,464.40.

How much would you invest in customer engagement activity to add one of these customers to your portfolio..?

If retention of these customers went up to 95% the eCLV would be: $3,602.95. How much would you invest into understanding how to retain more of these customers..?

Financial Services

The second example is from a financial services group. The average profit contribution for customers was $687, and the retention on average was about 80%. Using 8% cost of capital again the eCLV for the average customer would be $1,687 ($687 x 2.86).

However, this group discovered a customer sub group with different characteristics to the average. They had purchased products and service deeply and across channels. They were clearly getting value from the business. Their annual profit contribution was $2,767. The retention rate was high at 99% for many of those customers but let’s round down the retention rate down to 95%, and using 8% cost of capital again, the eCLV for those customers was, $2,767 x 7.31 = $20,227.

How much effort and investment would you put in to ensuring the only customer group that grows, was these awesome customers..?

Apply Different Reasoning

I have often used abductive reasoning to find some awesome customers within the portfolio. In other words, we can look for some customers that don’t quite fit the model of what we think an awesome customer is. But using CLV we have found a few that appear to be outside the norm. These customers can often give us insights into how they are getting value from us and potentially unlock the understanding of a new group of customers.

Call to action

These examples do demonstrates the flaw in averages. There is no such thing as an average customer, but we can have representative customers and specific customer groups.

Our task is to understand these various groups and the different value they represent to the business, and why. When we know where value is created in the customer portfolio, then we can create value deliberately. Engagement practices, sales, cross-sales and retention, tactics can be designed to align action with value creation for customers and the business.

CLV is useful in identifying the differences in the value from specific customer groups.

Learn more about the customer centric approach to business in:

- The New Path – describing the fives tenets of the customer centric approach the the nine imperatives for leaders

- Profit by Design – aligning resources and action to create value

This article is part of the Profit by Design book.

Make sure to sign up for my regular emails and receive the Definitive Guide to the Customer Centric approach to Business.