Net promoter score, or NPS, is very popular for many organisations. NPS goes beyond the passive feeling of ‘satisfaction’ to predicting customer behaviour. Importantly, whether customers will be an advocate for what you do, to their friends, family and colleagues.

In this age customers rely far more on the opinions of their network than advertising.

In this age of the customer we need to understand what drives advocacy and positive word of mouth.

NPS therefore – when used well – is a very important measure and can provide additional insights into how we build customer portfolios that are full of promoters.

Satisfaction is not enough

In the last century many organisations used to measure how satisfied their customers were. But we discovered in the 1990’s that satisfaction wasn’t a predictor of future behaviour. In other words, satisfaction is just something we feel in a moment (or two) but it does not mean that as a customer we will repurchase or even provide positive word of mouth. Therefore ‘customer satisfaction’ measures were like looking into a rear vision mirror when you are trying to figure where you are going (assuming you are driving forward of course). So how could businesses figure out what their customers were going to do..? This was the problem Fred Reichheld applied himself to.

Reichheld first landed on The Loyalty Effect (1996) and whilst all businesses need to figure out what customer loyalty means for them, it was lacking as a tool for improving performance. Reichheld partnered with Bain and Co and set about to find out how they could predict customer behaviour. They developed the ideas and concepts behind The Ultimate Question (2006), which we know today as Net Promoter Score.

Net Promoter Score (NPS)

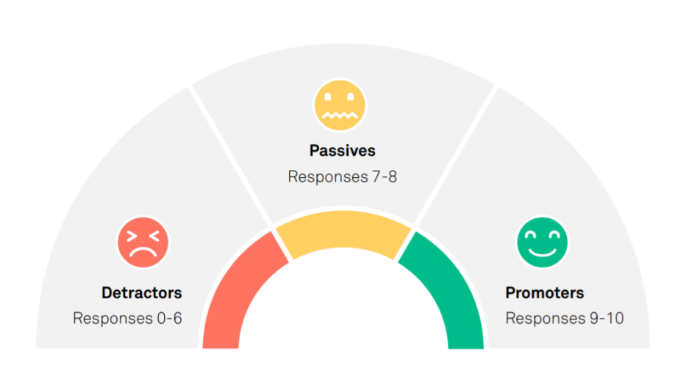

Net Promoter Score (NPS) is a measure; the percentage of customers that score you 9 or 10 (we’ll call these people Promoters), minus the percentage of customers that score you 0-6 (Detractors) when asked the ultimate question: “how likely are you to recommend [ insert your business/service/product ] to your friends, family and colleagues“. If you asked 100 of your customers the question and 25 people gave you a 9 or 10 (promoters, 25%); and 20 scored somewhere between 0 and 6 (20% detractors; then your net promoter score would be is 5 (25 minus 20).

Net Promoter Score – detractors, passives and promoters.

Bain and Reichheld tested and researched the ultimate question extensively. It was proven that this does in fact predict the future behaviour of a customer. Primarily in their inclination to provide word or mouth. Someone giving a service provider 9 or 10 would indeed be highly likely to provide positive word of mouth for that business. Those scoring 0 to 6, not so. In fact these people are likely tell others not to have anything to do with you. And (unfortunately) most likely will have a couple of stories they enjoy telling. The people that score 7 or 8 are classified as passives and not likely to recommend or give negative word of mouth.

NPS Today

NPS has (possibly) become too popular.

More to the point leaders and managers are using NPS in a way it was never intended.

In a recent Wall Street Journal article that describes NPS as a ‘dubious management fad‘, Reichheld is quoted as saying: I’m “astonished companies are using NPS to determine bonuses and as a performance indicator. That’s completely bogus. I had no idea how people would mess with the score behind it, to make it serve their selfish objectives.”

As soon as we add financial rewards to KPIs, people are likely to ‘mess’ with the measure to get their rewards.

As soon as we are messing with the data, we can no longer rely on what the measure is telling us. (Let’s ban KPIs).

NPS is for monitoring and understanding customer behaviour. NPS is for understanding if your improvement efforts to deliver value are working for these customers.

Using Net Promoter Score

NPS score – used well – is a great indicator of how your customers perceive the value you deliver. And, dependent upon the alternatives available to them, whether you will grow or not.

Why is this..? Because customers generally no longer trust advertising or marketing, nor sales people. But they do trust their social networks. Which is why the level of advocacy from your customer portfolio is a key determinant for your profitability and your growth over time. Customer advocate when they get a fair exchange of value. Their perceptions of value are driven by the functional factors or your offering. Then add the customer’s perception of value for money, plus their overall experience.

NPS then can be a measure then for your overall customer portfolio. But more importantly it is better when used with specific customer groups. Remember not all customers are equal.

Additionally NPS should not really be a measure of transactions. From the way the question is designed and perceived by the customer it is about overall perception of value, rather than a level of satisfaction with a transaction.

Here is a link to the article: NPS is more than just the number – which details how you can leverage the data you get from the NPS measure.

Where to next

We are in the age of the customer. In the last ten years or so customers have changed how they behave in five primary ways (read more in the New Manifesto for Sales).

The overall value of your customer portfolio is essentially derived from two key factors. One: Net Promoter Score ( compared to alternatives available to the customer). And, Two: the customer lifetime value of your various customer groups.

You can learn more about the customer centric approach to business in this post. Or in the Profit by Design book here.

Be sure to sign up for my newsletter and receive the ultimate Guide to the Customer Centric approach to Business.