Background

A lesson I learned from financial services is that there are certain types and groups of customers that add or detract value from the business.

Some researchers call these various groups value destroyers or enhancers, it can be tricky to identify them. But often we find that the acquisition tactics focus on selling products rather than acquiring specific types of customers.

Even more so, it is about attracting the right customers. So that the value of the customer portfolio grows.

A while ago we discovered a sub-group of customers that were getting value from the business in a whole range of ways. Many very practical and others a bit more intrinsic. The business in turn gained long tenure from these customers making them very profitable. Additionally these customers provided advocacy for the business. To me this is the classic two-way exchange of value, where both parties in the relationship benefit.

Customers differ in the value they offer

There are some customers that endeavour to get more value than they return.

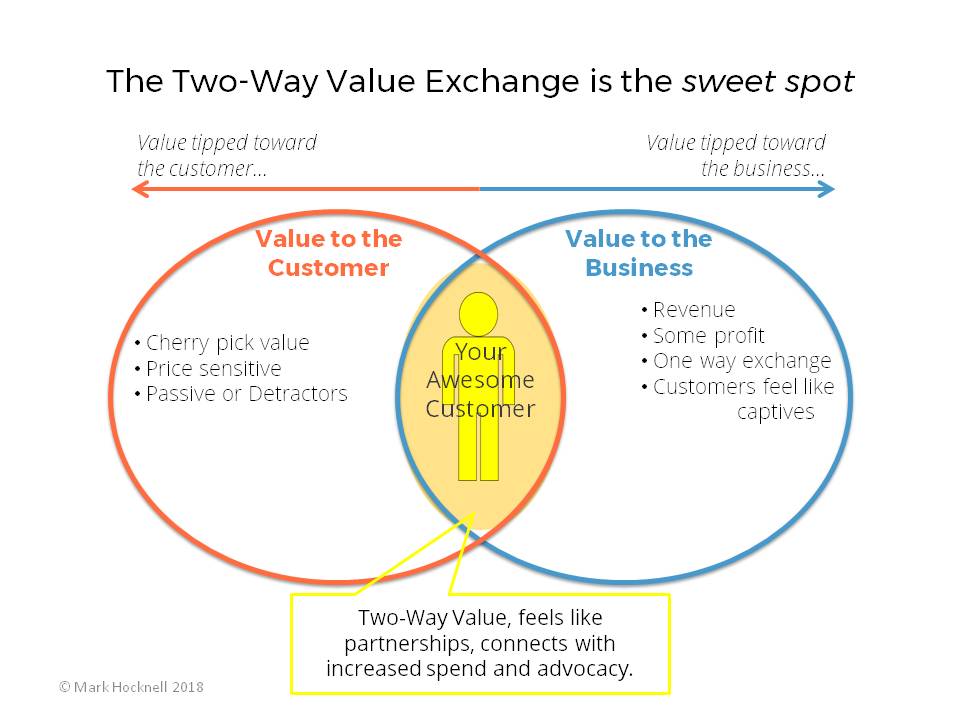

For example, there is a small portion of customer that will only buy on price. Price-focused customers are seeking deals and bargains. For any business they are low margin, high maintenance customers, and what word of mouth will they provide..? Probably nothing except bragging rights on the deals they got. Value is this context is tipped too much towards the customer for the long-term relationship to work. There has to be a fair and mutual exchange of value.

Likewise, some businesses like to get more from their customers than they return. Telcos and Big Banks are often in the negative-word-of-mouth spotlight because their customers feel the fees (for just about everything) are way out of control. And are completely only about improving bank profits, rather than value-adding services for the customer.

The Two-way Value Exchange

When value is tipped more towards the customer, the business doesn’t receive the value it deserves for the products and services provided.

When customers are in this zone they tend not to provide positive word of mouth, because they are not really getting the value the business delivers. They become passive or possibly detractors by encouraging others to treat this business the same way.

Similarly, when businesses are perceived to get more out of the relationship than their customers feel they should, then these customers will complain to anyone that will listen.

The Sweet Spot

The sweet spot is where the customer gets the value the business delivers. And the business in turn receives a fair price for these services and advocacy from the customer. The customers value the solutions and services the business provides. The business has profitable promoters in their customer portfolio. (see Dr Peter Fader’s views in this article)

To understand this idea of the two-way value exchange more deeply, we should look at the value equations from two perspectives, firstly the customer in this article: How customers define value. Then from the business perspective in: Net Promoter Score and Customer Lifetime Value.

This article is part of the Profit by Design framework, you can read more about Profit by Design here.

Or learn more about the Profit by Design book here.

You can learn more about applying a customer centric approach to business on this page, or sign up for the newsletter and receive the Ultimate Guide to the Customer Centric approach to Business.